Note: This post is the analysis of the following large trade by us. It is not financial advice. The stock market is risky, and options trade may result in significant loss. Please do your own research before making any trade. Check and agree to full terms on our website before considering this information.

Large Trades

| Ticker | C/P | Strike | Expiration | Price | Size | Premium | Delta | DTE | Condition |

| SPOT | Call | 185 | 08/18/23 | $8.60 | 7600 | $6.536M | 0.46 | 31 | Spread |

About the trade for SPOT 2023-08-18 C185

- bid: $8.60, ask: $8.80, trade price: $8.60, trade size: 7600, total premium: $6536000.0

- Possible trade type: STO (sell to open).

- Possible trade motivation: reversal play. Resistance level at 180.

- Note: ER on July 25, another leg of vertical spread buys C200 at $4.15.

- Trading Strategy: replicate the large trade (vertical spread) with smaller size.

- Exit plan: take profit when stock price is near level 160 and level 150.

About the company

- ‘name’: ‘Spotify Technology SA’, ‘country’: ‘LU’, ‘finnhubIndustry’: ‘Media’, ‘ipo’: ‘2018-04-03’, ‘marketCapitalization’: ‘28268.6M’, ‘shareOutstanding’: ‘190.4M’

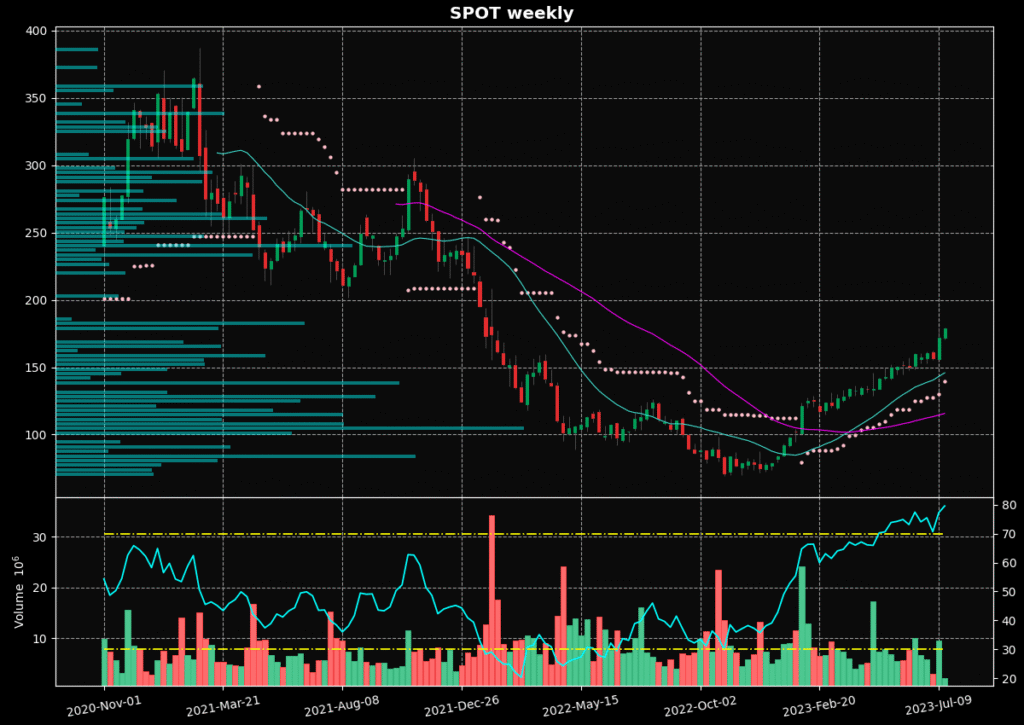

Weekly stock price chart

Daily stock price chart

Update on 2023-07-28

- Stock price hit low of 139.15 on Jul 25 after ER.

- Options expired worthless, leading to 100% gain.

- 2023-07-28 04:45:00 | Spotify (NYSE: SPOT) listeners in America are going to see their monthly bill rise for the first time ever. The leading “audio platform,” as management prefers to call itself, made a broad-based price increase for individual and family plan subscribers in the U.S. and other major markets around the world. Management addressed several questions on the price increase.

Daily stock price chart

Options contract price chart